Finding the right accounting firm for your corporation in Korea

Tax and accounting services are essential functions in running a company. In this article, I would like to share three points to check before you make a decision on hiring an accounting firm in Korea. Point 1. Make sure you research how long they have been in the professional tax advisory business, and they were […]

Everything about Flat Income Tax Rate for Expats in South Korea

What is a Flat Tax Rate? A flat tax rate is 19%, and it is a single tax rate applied to all levels of income. In contrast, a normal personal income tax rate ranges between 6% and 42% in Korea. This income tax rate is a progressive rate, which increases as the tax base goes […]

Do foreigners pay tax in Korea for selling US stocks?

When you have HongKong passport but work in Korea, where do you pay tax on capital gains you have made last year from selling US stocks? When it comes to tax, the term of ‘resident’ or ‘non-resident’ is often used rather than nationality or passport country. If you have an address in Korea and have […]

Branch office vs. Subsidiary in Korea

The very first step to entering the Korean market and starting a business as an incorporated entity is deciding on the type of business entity you want to establish. While there are various types to choose from, this document will focus on two of the most popular: the branch office and the local subsidiary. What […]

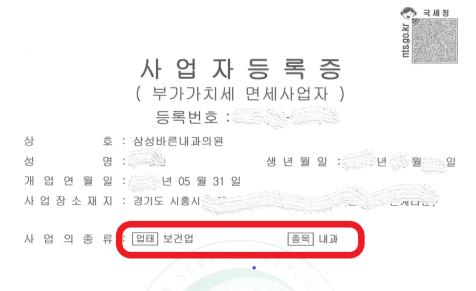

A Guide to Tax Life in Korea : Do you know your business code?

When you start business in Korea, you have to register at Tax Office for Business Registration Certificate which looks like this. But do you know what your business code(or 업종코드)is? The business code is not even shown on business registration certificate. However, it is much more important than you think. Business code is a 6 […]